In a world where digital banking is rapidly becoming the norm, the Revolut card continues to be a popular choice for people who seek flexibility, convenience, and innovative financial tools. Whether you’re an international traveler, a freelancer, or just someone looking for a modern solution to everyday banking, Revolut offers features that go beyond traditional bank accounts.

In this comprehensive guide, we’ll break down what Revolut is, how it works, and review customer experiences, to help you determine if Revolut is the right choice for you in 2024.

What is Revolut?

Revolut is a digital banking platform launched in July 2015 by Nikolay Storonsky and Vlad Yatsenko. It started as a simple app offering users the ability to exchange currencies at interbank rates but has since evolved into a full-fledged financial super-app. By 2024, Revolut offers a range of services, including multi-currency accounts, stock trading, cryptocurrency exchanges, and even budgeting tools — all accessed via the Revolut card and mobile app.

Revolut operates as an online-only bank, meaning there are no physical branches. Instead, everything from opening an account to managing your finances is done via the Revolut mobile app. In 2024, Revolut serves millions of users globally, including a large and growing customer base in Italy, offering innovative solutions tailored to different financial needs.

How Does the Revolut Card Work?

The Revolut card is central to the Revolut experience. It works just like any other debit card, but with more flexibility and added financial tools. Here’s how the Revolut card functions in 2024:

1. Multi-Currency Support

One of the key benefits of the Revolut card is that it allows users to hold and spend money in multiple currencies. The card automatically converts your balance into the local currency when you make purchases abroad, using the interbank exchange rate. This feature is particularly useful for frequent travelers, as it eliminates high foreign exchange fees typical with traditional banks.

2. Instant Payments and Transfers

With the Revolut card, you can send and receive payments instantly between Revolut users, without fees. You can also make bank transfers in over 30 currencies, again using the best exchange rates available.

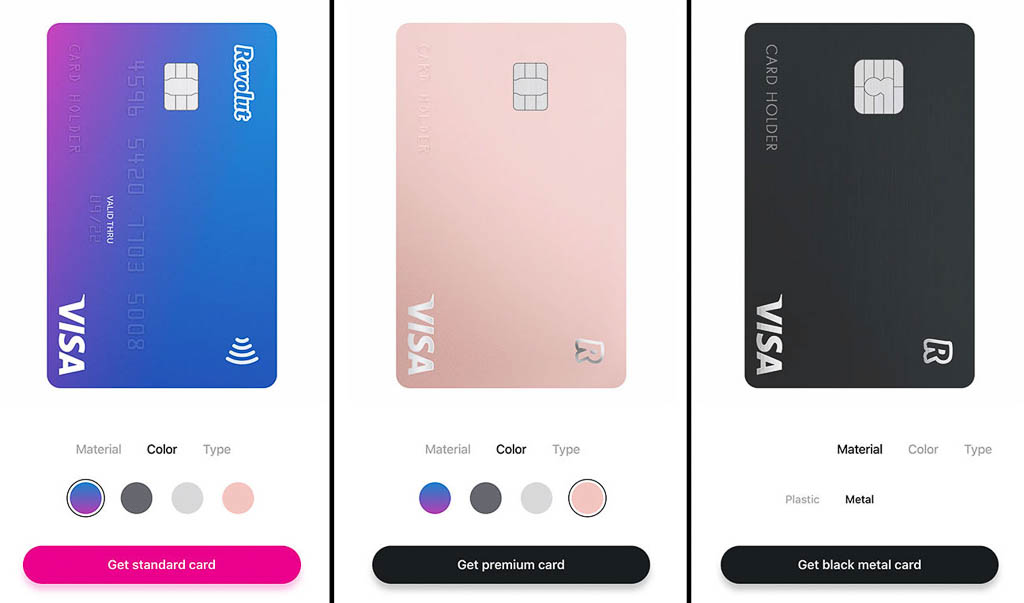

3. Subscription Tiers

In 2024, Revolut offers several tiers of service, each with different fees and features:

- Standard: The basic free tier, offering access to Revolut’s essential features like foreign exchange at interbank rates, instant transfers, and budgeting tools.

- Plus: A low-cost option with added benefits, including priority customer support, enhanced security features, and limited cashback options.

- Premium: A mid-tier option with more perks, such as higher withdrawal limits, overseas travel insurance, and virtual card services.

- Metal: The highest tier, which includes all Premium features, plus exclusive cashback on every purchase, a sleek metal card, and concierge services.

4. Virtual Cards

Revolut allows you to generate virtual cards for online shopping. These cards provide an extra layer of security as they can be deleted after use. In 2024, Revolut also offers disposable virtual cards, which automatically destroy themselves after a single use to protect your card information from being stolen.

5. Cryptocurrency and Stock Trading

In addition to standard banking services, Revolut allows users to trade stocks, cryptocurrencies, and commodities directly from their app. Users can easily buy fractions of shares or cryptocurrencies like Bitcoin and Ethereum, making it a great choice for those looking to dip their toes into investing without needing a separate brokerage account.

6. Revolut Junior

Revolut caters to families with Revolut Junior accounts, which are designed for children and teens. This feature allows parents to set spending limits, oversee transactions, and teach their kids responsible financial habits early on.

7. Security Features

Revolut places a strong emphasis on security. Users can instantly freeze and unfreeze their cards via the app, set transaction limits, and receive real-time notifications for every purchase. Additionally, two-factor authentication (2FA) is enabled to ensure that your account is always protected.

How to Get a Revolut Card in 2024

Opening a Revolut account in 2024 is quick and straightforward. Here’s how you can get started:

Step 1: Download the App

You can download the Revolut app from the App Store (for iOS users) or Google Play (for Android users).

Step 2: Set Up Your Account

Once the app is installed, you’ll need to provide your phone number, email address, and personal identification (such as a passport or ID card). Revolut uses this information to verify your identity, as required by European banking regulations.

Step 3: Choose Your Plan

After setting up your account, you’ll be prompted to choose a subscription plan (Standard, Plus, Premium, or Metal). Select the one that best fits your needs, and you can always upgrade later if necessary.

Step 4: Get Your Card

Once your account is activated, you’ll receive a physical Revolut card by mail. In the meantime, you can use the app’s virtual card feature to start making purchases immediately.

Step 5: Fund Your Account

You can load money into your Revolut account via a bank transfer, credit/debit card, or by receiving payments from other Revolut users.

Revolut’s Customer Reviews in 2024

To help you make a well-informed decision, let’s take a look at what actual users have to say about Revolut in 2024. Below are some common themes found in customer reviews:

1. Ease of Use

Most customers praise Revolut for its user-friendly interface and simple onboarding process. Many people appreciate how quickly they can open an account and start using their card for everyday transactions.

- Review Example: “The app is incredibly easy to use. I love the intuitive design, and setting up my account took just minutes. The budgeting tools are very helpful!” – Marco, 32, Rome.

2. Travel Features

Revolut is frequently lauded for its exceptional features tailored to travelers. Customers love the real-time currency exchange and the lack of foreign transaction fees.

- Review Example: “I travel frequently, and the Revolut card has been a lifesaver. The ability to convert currencies instantly and without fees is amazing!” – Alessia, 28, Milan.

3. Security

Revolut’s security features, especially the ability to freeze the card instantly, are highly appreciated by users who have had issues with card fraud in the past.

- Review Example: “The instant freeze option has saved me from fraud multiple times. I feel very secure using Revolut, and I get notified of every single transaction.” – Luca, 45, Naples.

4. Customer Support

While many customers are satisfied with Revolut’s customer service, those on the free plan sometimes mention longer wait times for support. Premium and Metal plan members, however, enjoy priority support.

- Review Example: “Customer service could be a bit faster on the free plan, but upgrading to Premium has made a big difference. I get my questions answered within minutes now.” – Sara, 25, Florence.

Is Revolut Right for You?

Deciding if Revolut is right for you in 2024 depends on your financial needs and habits. Here are some factors to consider:

Advantages of Revolut:

- Frequent Travelers: If you travel often and need to manage multiple currencies, Revolut’s real-time exchange rates and low fees make it a top choice.

- Budget Conscious: Revolut’s budgeting tools are excellent for users who want to track and manage their spending effectively.

- Investors: With the ability to trade stocks, cryptocurrencies, and commodities, Revolut is a good option for casual investors.

- Security-Minded Users: Revolut offers top-tier security features, including two-factor authentication and the ability to freeze and unfreeze your card at will.

Potential Drawbacks:

- Customer Support: If you’re on the free plan, you may experience longer wait times for customer service.

- Premium Features: While the free plan offers a lot, some of the best features, like free ATM withdrawals abroad or travel insurance, are only available with paid plans.

The Future of Revolut: Innovations to Look Forward to in 2024

Revolut is continuously innovating, and in 2024, they are expected to introduce more personalized financial insights driven by AI, offering users tailored advice on managing their money more effectively. Additionally, Revolut is looking into expanding their investment offerings, making it even easier for users to invest in diverse markets from within the app.

As Revolut continues to grow its user base and services, we can expect further improvements in customer experience, security, and financial tools.

Conclusion: Should You Get a Revolut Card in 2024?

Revolut offers a comprehensive, flexible, and modern approach to banking in 2024. Whether you’re looking for a simple way to manage your money, need advanced travel features, or are interested in dipping into investing, Revolut has something for everyone.

With its easy-to-use interface, robust security measures, and innovative tools, Revolut stands out as one of the best digital banking options available today. Take the time to explore the different plans and features to see which one best meets your financial needs.

If you’re a frequent traveler, Revolut’s multi-currency capabilities and interbank exchange rates make it a no-brainer. If you’re a security-conscious individual or enjoy investing on the side, the additional features like virtual cards and cryptocurrency trading are great bonuses.

Ultimately, in 2024, the Revolut card continues to be a flexible and forward-thinking choice, giving users more control and transparency over their finances than traditional banking options. Whether you’re looking to streamline your day-to-day spending or take your money management on the go, Revolut is worth considering.

Official Launch Release Date: Revolut was initially launched in July 2015 and continues to innovate with new features and updates regularly in 2024.

Customer FAQs

- Is Revolut safe to use? Yes, Revolut is highly secure, offering features like two-factor authentication and the ability to freeze/unfreeze your card instantly.

- How does Revolut handle foreign currency exchanges? Revolut allows you to exchange currencies at interbank rates, making it more cost-effective for international travel.

- Can I invest in cryptocurrencies using Revolut? Yes, Revolut provides users with the ability to buy and sell cryptocurrencies directly from the app.

With Revolut’s comprehensive banking tools, travel-friendly features, and cutting-edge security, it’s easy to see why so many people are switching to Revolut in 2024. Whether you’re looking for a new way to manage your finances or simply want more flexibility in how you spend, the Revolut card is an excellent choice.

Promo

Challenge open:

Revolut referral bonus:

Benefits for you and your friends:

- Send and request money

- Divide and pay the expenses

- Save money in company

And much more!

Open the Revolut account.