As the world becomes increasingly globalized and travel becomes more accessible, managing multiple currencies while abroad has become a necessity. Travelers, expatriates, and digital nomads alike are looking for financial tools that can simplify currency exchanges and minimize fees. Multi-currency cards, designed to streamline these processes, are now an essential part of modern travel.

In this comprehensive guide, we’ll explore what multi-currency cards are, how they work, and provide customer reviews to help you select the best multi-currency card for travel in 2024. We’ll also provide official launch dates for some of the top products on the market.

What Is a Multi-Currency Card?

A multi-currency card is a type of prepaid or debit card that allows you to hold and spend in multiple currencies. Unlike traditional cards, which may charge high foreign transaction fees and offer poor exchange rates, multi-currency cards are designed specifically for people who travel frequently and need to manage various currencies more efficiently. These cards eliminate the need to carry multiple cards or cash for different countries.

Multi-currency cards often come with an associated mobile app that allows users to:

- Hold multiple currencies: Users can store funds in several currencies simultaneously.

- Exchange currencies: Convert between currencies at competitive rates.

- Spend globally: Use the card to make purchases or withdraw cash in different currencies, usually without foreign transaction fees.

How Do Multi-Currency Cards Work?

A multi-currency card works similarly to a regular debit or prepaid card, but with added features to accommodate currency management. Here’s how it typically works:

1. Load Funds

You start by loading your card with funds in your home currency (for example, EUR or USD). Many multi-currency cards allow you to load money directly via bank transfer, debit card, or credit card.

2. Exchange Currency

Once your card is funded, you can exchange your home currency into other currencies, such as GBP, USD, JPY, or AUD, using the mobile app or online platform associated with the card. The exchange rates are often more competitive than those provided by traditional banks or airport currency exchanges.

3. Hold Multiple Currencies

Once the funds are converted, you can hold several different currencies in your card account. Most multi-currency cards will display your balances in each currency, allowing you to manage them efficiently.

4. Spend and Withdraw

When traveling abroad, the card automatically selects the correct currency for the country you’re in. This means if you’re in the UK and have GBP on your card, it will use your GBP balance for purchases or cash withdrawals. If you don’t have the local currency on your card, it will either convert from your home currency or the next available currency in your account, usually at a fair rate.

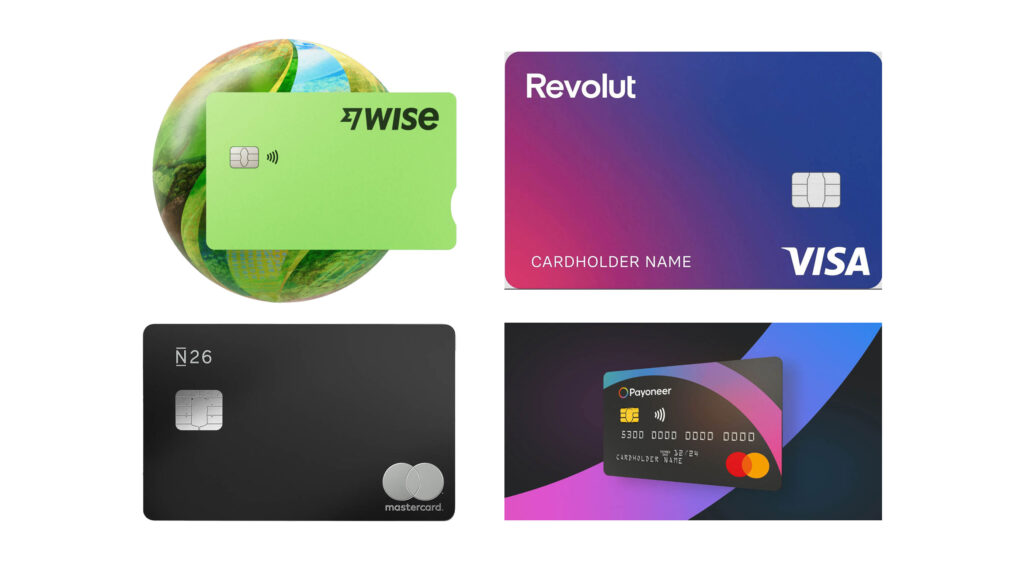

Top Multi-Currency Cards in 2024

Several companies offer multi-currency cards, each with unique features, fees, and benefits. Below, we review some of the top cards in 2024 to help you make the best decision for your travels.

1. Wise (formerly TransferWise) Multi-Currency Card

- Launch Date: Originally launched in 2017, Wise has become a top choice for international travelers.

- Key Features:

- Supports over 50 currencies.

- Transparent, mid-market exchange rates.

- No hidden fees for card transactions or ATM withdrawals up to a limit.

- Real-time notifications and transaction tracking via the mobile app.

- Customer Reviews:

- Positive: Customers love Wise’s transparent fees and competitive exchange rates. The mobile app is user-friendly, and managing multiple currencies is seamless.

- Negative: Some users have mentioned that the ATM withdrawal limits can be restrictive for long trips.

2. Revolut Multi-Currency Card

- Launch Date: July 2015, Revolut has continuously updated its multi-currency offerings.

- Key Features:

- Supports 30+ currencies.

- Instant currency exchange at interbank rates.

- Virtual cards for added security.

- No foreign transaction fees for cardholders (within certain limits).

- Customer Reviews:

- Positive: Many users appreciate the real-time exchange rates and the ability to freeze/unfreeze the card with a single tap. The Revolut app’s budgeting tools also make managing travel expenses easier.

- Negative: The free version has a monthly withdrawal limit, after which fees apply.

Read more:

- Revolut Card 2024: What It Is, How It Works and Customer Reviews

- Travel for Free with Revolut: Here’s How to Use RevPoints

3. N26 Multi-Currency Card

- Launch Date: N26 launched in 2013, and by 2024, it’s among the most popular digital banks in Europe.

- Key Features:

- Zero foreign transaction fees on purchases.

- Integrated with TransferWise for easy currency exchange.

- Premium account holders get free ATM withdrawals worldwide.

- Real-time notifications for every transaction.

- Customer Reviews:

- Positive: N26 customers highlight its ease of use and the absence of foreign transaction fees as key benefits. The app provides clear tracking of spending across different currencies.

- Negative: N26 is currently only available to residents of certain European countries, limiting its accessibility.

4. Payoneer Multi-Currency Card

- Launch Date: Payoneer started its services in 2005, focusing primarily on freelancers and online businesses.

- Key Features:

- Can receive payments in multiple currencies.

- Supports over 150 currencies.

- Instant access to funds through a prepaid Mastercard.

- Widely accepted by online marketplaces and businesses.

- Customer Reviews:

- Positive: Freelancers love the ability to get paid in various currencies and easily withdraw funds using the Payoneer card. The card’s global acceptance is a major perk for digital nomads.

- Negative: Some users find Payoneer’s fees on certain types of transactions to be higher than other multi-currency cards.

How to Choose the Best Multi-Currency Card for Travel in 2024

Choosing the right multi-currency card depends on your travel habits, financial needs, and preferences. Here are the key factors to consider when selecting a card:

1. Currency Support

The number of currencies a card supports is crucial, especially if you travel to multiple destinations frequently. Cards like Wise and Revolut support a wide variety of currencies, making them ideal for global travelers.

2. Exchange Rates

Look for a card that offers competitive exchange rates. Cards like Wise and Revolut are known for using mid-market rates (the same rate you see on Google), while others may charge a markup.

3. Fees

Pay attention to any hidden fees, such as ATM withdrawal fees, inactivity fees, or exchange rate markups. Some cards, like Revolut and N26, have fee-free limits on withdrawals, but additional fees can apply beyond those limits.

4. Security Features

Security is important, especially when traveling. Many cards offer features like virtual cards, two-factor authentication, and the ability to freeze/unfreeze your card through an app.

5. App Functionality

Since multi-currency cards are managed mostly via mobile apps, make sure the app is intuitive and provides real-time transaction tracking, budgeting tools, and instant notifications. A good app experience can make managing multiple currencies much simpler.

6. Global Acceptance

Ensure that the card you choose is accepted in the countries you plan to visit. Cards linked to major payment networks like Mastercard or Visa will have the widest acceptance.

Customer Reviews in 2024: What People Are Saying

1. Positive Feedback

Most customers appreciate the convenience and flexibility that multi-currency cards offer, especially for frequent travel. Users enjoy the competitive exchange rates, ease of use via mobile apps, and the elimination of foreign transaction fees.

- Example Review: “I used my Wise card throughout Asia and Europe, and the ability to convert currencies instantly saved me hundreds in fees. The app is super intuitive!” – Chiara, 31, Italy.

2. Areas for Improvement

Some users find the withdrawal limits and fees on some multi-currency cards to be restrictive, particularly for extended trips where large amounts of cash are needed. Others have mentioned occasional delays in customer service responses, especially for free-tier accounts.

- Example Review: “Revolut is great for managing multiple currencies, but the free version’s ATM withdrawal limit is too low for long trips. Still, the exchange rates make up for it.” – Luca, 28, Milan.

Which Multi-Currency Card Is Best for You?

In 2024, multi-currency cards offer an unparalleled level of convenience and flexibility for travelers. With options like Wise, Revolut, N26, and Payoneer, you can manage multiple currencies, avoid hefty foreign transaction fees, and enjoy competitive exchange rates—all through easy-to-use mobile apps.

Ultimately, the best card for you depends on your travel habits:

- Wise: Ideal for those who need access to multiple currencies and want transparent exchange rates with no hidden fees.

- Revolut: A great choice for those who need a broader range of services like cryptocurrency and stock trading, along with their travel needs.

- N26: Perfect for frequent European travelers who want fee-free global purchases and premium account features.

- Payoneer: The top pick for freelancers and digital nomads who get paid in multiple currencies.

No matter your choice, a multi-currency card will make your travels smoother and more cost-effective in 2024.

Official Launch Release Dates of Multi-Currency Cards

Here’s a quick look at the official launch dates of some of the most popular multi-currency cards:

- Wise Multi-Currency Card: Originally launched in 2017, Wise has continued to grow, offering support for more than 50 currencies and providing some of the most competitive exchange rates in the market.

- Revolut Multi-Currency Card: Revolut was launched in July 2015. Over the years, it has transformed from a simple prepaid card provider into a full-fledged financial app, offering banking services, cryptocurrency trading, and much more.

- N26 Multi-Currency Card: Launched in 2013, N26 was one of the first European digital banks to offer a multi-currency option, with seamless currency exchanges and fee-free purchases for premium users.

- Payoneer Multi-Currency Card: Payoneer began offering its multi-currency services in 2005, initially focusing on helping freelancers and businesses manage cross-border payments in various currencies.

Final Thoughts: Multi-Currency Cards in 2024

As we move further into 2024, multi-currency cards continue to be a game-changer for travelers, freelancers, and anyone dealing with multiple currencies. These cards offer flexibility, cost-efficiency, and ease of use that traditional banking and currency exchange services simply can’t match.

Why You Should Consider a Multi-Currency Card

- Lower Costs: Multi-currency cards minimize or eliminate foreign transaction fees and offer favorable exchange rates.

- Convenience: With mobile apps for real-time control, easy fund transfers, and currency exchanges, managing your money while traveling has never been simpler.

- Security: Many of these cards offer advanced security features like virtual cards, real-time notifications, and the ability to freeze your card instantly.

When choosing the best multi-currency card for travel in 2024, consider how much you travel, which currencies you need, and the fees associated with each card. For frequent international travelers, cards like Wise and Revolut are excellent choices due to their broad currency support and ease of use.

Frequently Asked Questions (FAQs)

1. What is the difference between a multi-currency card and a regular debit/credit card?

A regular debit or credit card typically charges foreign transaction fees and offers less competitive exchange rates. In contrast, a multi-currency card allows you to store and manage multiple currencies, often with lower fees and better rates.

2. Can I withdraw cash using a multi-currency card?

Yes, you can use multi-currency cards to withdraw cash in local currencies. However, some cards may have withdrawal limits, and fees may apply after a certain number of withdrawals.

3. Is a multi-currency card safe?

Yes, multi-currency cards are generally safe. They offer security features like virtual cards, two-factor authentication, and the ability to lock/unlock your card through a mobile app.

4. Can I use a multi-currency card for online purchases?

Absolutely! Multi-currency cards can be used for online shopping in different currencies. This feature is particularly helpful for freelancers and remote workers who get paid in various currencies.

Conclusion: The Future of Multi-Currency Cards in 2024

As the world becomes more interconnected, the demand for easy, affordable ways to manage multiple currencies will only increase. Multi-currency cards are well-positioned to meet this demand, offering travelers and global professionals a simple and cost-effective solution.

Whether you’re a frequent flyer, a digital nomad, or simply someone who enjoys exploring new destinations, a multi-currency card can save you both time and money. In 2024, cards like Wise, Revolut, N26, and Payoneer are leading the way in innovation, transparency, and convenience.

So, if you’re planning your next adventure or want more control over your finances while abroad, consider upgrading to a multi-currency card—it’s a smart move for the modern traveler.